Important Notice: Grace Period Has Expired!

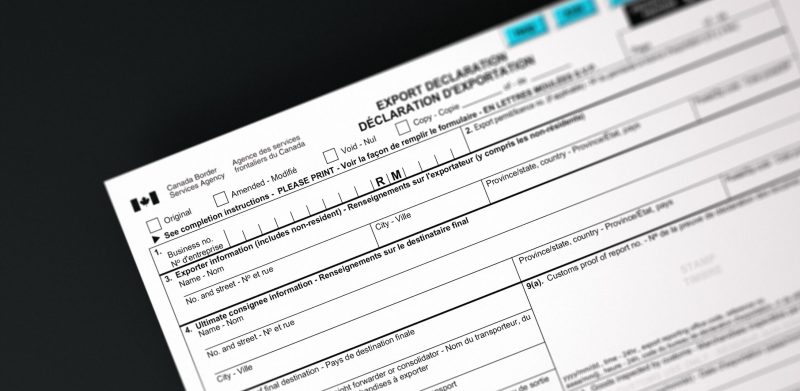

The grace period for making voluntary disclosures to the Canada Border Services Agency (CBSA) for goods that were exported from Canada to countries other than the United States – and which were transshipped through the U.S. and not reported to CBSA on a B13 Export Declaration – has expired.

Penalties are now applicable

It is important to remember that even though it is not necessary to file a B13 report for goods that are being shipped to the United States because of a bilateral arrangement, companies are still required to make a B13 declaration for any goods that will transit through the U.S. to another country, regardless of the origin of the goods or if they are controlled or not.

- Example: if you are exporting goods to Mexico by truck and the goods will transit through the U.S. or are being sent to a U.S. address for furtherance to Mexico, you must issue a B13 declaration and report the goods to CBSA.

Keep in mind that it is the exporter’s responsibility to ensure goods are properly declared at time of export and that failure to do so will result in fines. Forwarders should advise their clients of the importance of filing proper export declarations and of the consequences of non-compliance.

Three strikes you definitely want to avoid!

Applicable penalties levied against the exporter per shipment are as follows:

1st Offence = $500.00

2nd Offence = $750.00

3rd Offence = $1,500.00

If you have any questions about the applicable regulations – or want to make sure your company’s cash flow does not end up lining government coffers – contact your customs broker today so that you don’t strike out at the border!